Table of Contents

Key Findings

- The tourism sector is at the forefront of COVID-19 job losses in Canada. Employment fell over 42% between February and April 2020, and in the last two months have accounted for 27% of all job losses in the country.

- Many young Canadians rely on tourism jobs to start their career. The lack of available jobs in this sector is likely to have long-term consequences for their labour market outcomes.

- The tourism sector relies on revenue from local patrons as well as domestic and international travellers. The pace at which each will begin to recover will vary by industry and business. Local demand is expected to recover first, followed by demand from elsewhere in the country, and finally by international tourists.

- New business models, protocols and regulations, and modified products and services will help the sector adapt, recover and move forward as emergency restrictions lift. Labour market information on new skills requirements that emerge as a result of these changes will be essential.

Introduction

The COVID-19 pandemic and the resulting measures to prevent its spread (social distancing, travel restrictions, school and business closures, etc.) have led to unprecedented job loss and business failures across Canada. New data from the Labour Force Survey (LFS) confirm that the economic impact of this health crisis affects different sectors of the economy in unique ways. This LMI Insight Report focuses on one sector that has been particularly hard hit - tourism.

The tourism sector is broad, encompassing distinct services that provide transportation and travel, accommodation, food and beverage, recreation and entertainment (see Box 1). In all these subsectors, tourism relies heavily on faceto-face interaction with customers. It is therefore not surprising that tourism is at the forefront of COVID-19 job losses, with over 800,000 jobs lost between February and April 2020. While it is still early days, recovery in the tourism sector is expected to proceed in three phases related to the three sources of demand: non-tourism demand from local customers who frequent tourism businesses (such as restaurants, events and attractions), domestic tourists, and international tourists. As quarantine measures ease, we expect local demand to recover first, followed by demand from elsewhere in the country, and finally by international tourists. The pace at which these activities resume remains uncertain; much depends on our collective sense of security that the health crisis is under control.

The Current Situation

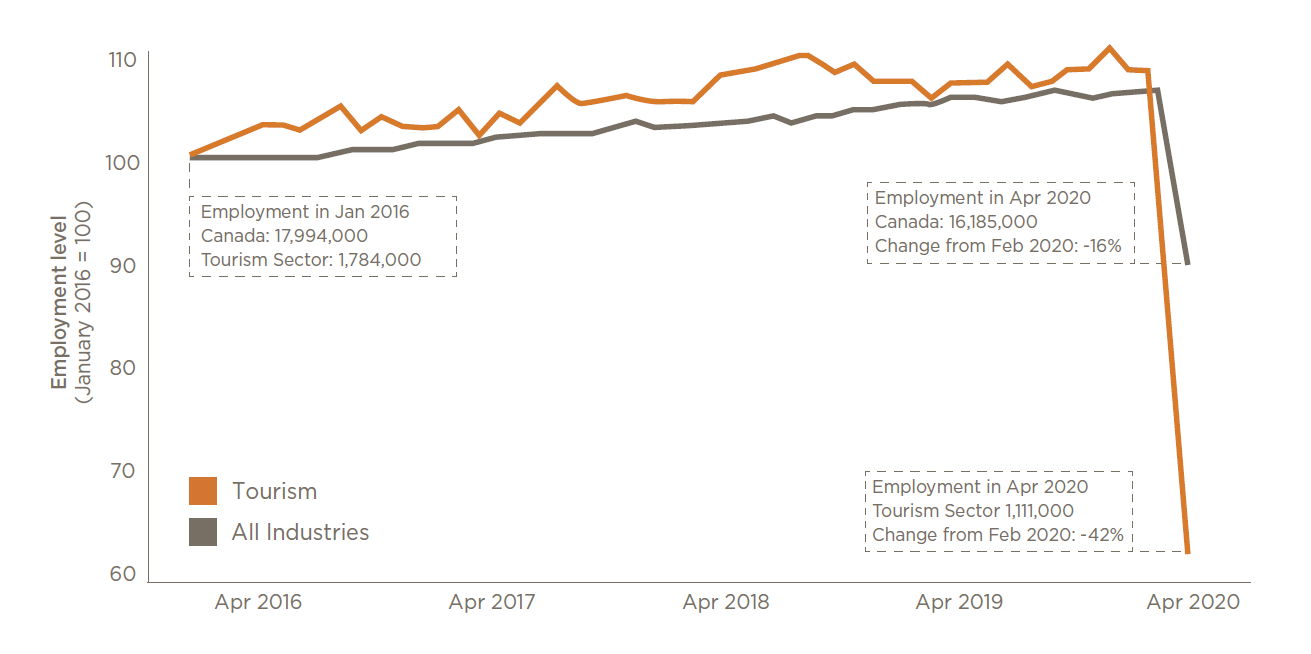

Analyzing data from the LFS, we see a net increase in employment, both for the tourism sector specifically and for Canada overall, from January 2016 to February 2020 (see Figure 1). In February 2020, nearly two million (1,927,000) Canadians worked in tourism.1 By April 2020, the sector had shed 816,000 jobs when employment collapsed to 1,111,000 (see Figure 1). This represents a 42% drop in employment in two months versus a Canadawide employment decline of 16%.

Box 1: The Tourism Sector in Canada

Tourism is a critical part of Canada’s economy, creating jobs and opportunities for millions of people. In fact, one in nine Canadian jobs are in the tourism sector. Tourism is also the largest employer of youth, as well as an important source of jobs for immigrants. In 2018, domestic and international tourism contributed almost $80 billion and $22 billion to Canada’s economy, respectively. In total, the tourism sector contributes more than 2% of Canada’s GDP. Tourism is also our largest service export with over 22 million overnight international visitors coming to Canada in 2019.

Figure 1: Between February and April 2020, the tourism sector lost 816,000 jobs.

Employment level (Jan 2016 = 100), Canada, seasonally adjusted.

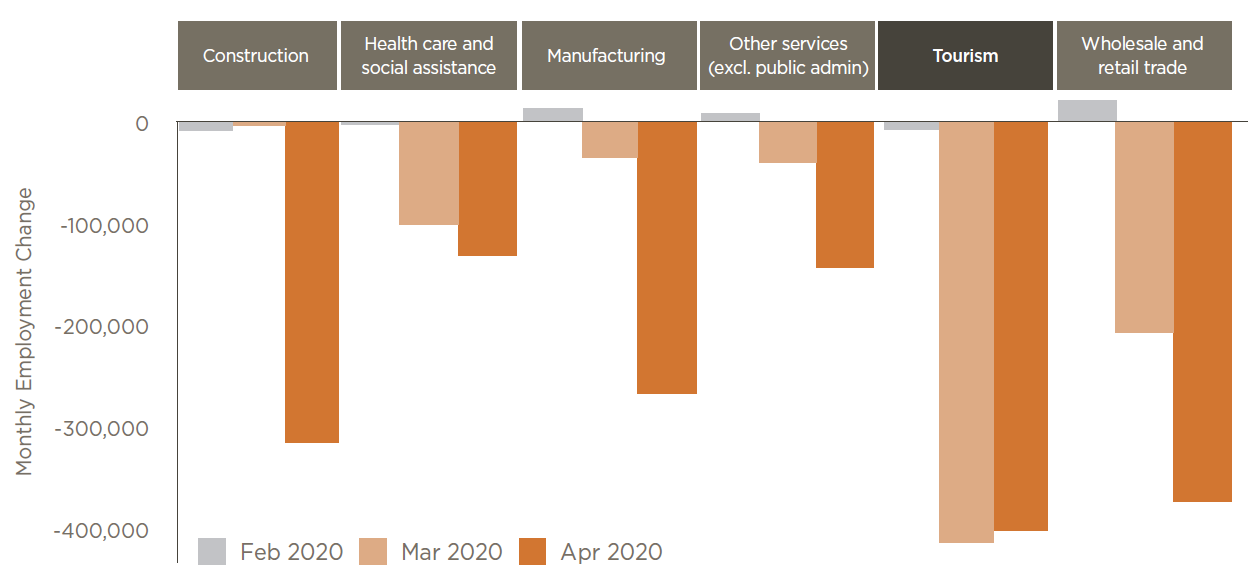

Even compared to other sectors significantly impacted by the pandemic, tourism experienced more job losses in both absolute and relative terms in March and April 2020 (see Figure 2). In March 2020, employment in the tourism sector decreased by over 414,000 jobs; in April 2020, approximately 401,000 more jobs were lost.

Figure 2: Employment in tourism has fallen more than in other sectors.

Change in employment, Canada; Sectors with declines exceeding previous economy-wide record job losses, seasonally adjusted.

Implications

Canada’s tourism sector was hit by COVID-19 as early as February 2020 with the number of travellers coming from China dropping by 60.6% over the previous February. In the second week of March, leading indicators showed the demand for tourism services began to contract as first international then domestic travel were restricted. Travel restrictions were swiftly followed by lockdowns, border restrictions and the closure of non-essential services across the country. Incoming revenue to tourism firms dried up, leaving many unable to retain staff. Total employment in the tourism sector has now reduced to levels not seen since the 1980s. Despite this unprecedented scale of job loss, tourism still employs over a million Canadians (6.9% of the labour force in April 2020), although many are working reduced hours.

Besides tourists, the sector also derives income from local residents. This means that even though travel restrictions remain in place, some services and employment can return when busineses closures ease. Recreation facilities and restaurants, for example, derive 75% and 78% of their revenue (respectively) from non-tourists. They will be able to rehire employees as local demand increases. Of course, restaurants, attractions and recreation facilities must comply with ongoing physical distancing rules, limiting the number of customers at any given time. In addition, it is not clear how quickly the public will re-establish the comfort level necessary to resume recreational and tourism activities. Easing restrictions alone will not create a return to pre-COVID employment levels. As well, much remains uncertain about the ability of these businesses to remain financially viable when operating at significantly reduced capacity.

The accommodations industry - deriving 87% of its revenue from domestic (54%) and foreign (33%) tourists - must wait for travel restrictions to lift before it can begin to recover. This is also true of transportation and travel services. Travel across provincial borders remains limited even as restrictions within provinces ease. Within-province travel also remains contentious due to fears of spreading COVID-19 from areas with higher concentrations of the virus. How soon domestic and international travel will resume remains unknown. International travel will undoubtedly be the last area to recover.

Of great concern is the loss of the 2020 summer season. In Canada, as elsewhere, the tourism sector is highly seasonal, obtaining most of its earnings during the high-volume summer season. Typically, businesses in this sector rely on the revenue from June, July and August to make the year profitable. Regardless of how much demand returns from local patrons, summer demand from domestic and international tourists is essential for viability across all tourism subsectors. If this summer is a "lost" season, the long-term impact on tourism may be devastating. Many tourism businesses will find it difficult to survive until summer 2021. Even then, the economic fallout from COVID-19 is likely to drag down demand for several years. Although tourism employment may begin to rebound, it is unlikely to return to its 2019 level for many years to come.

The Role of LMI

Labour market information will be critical in understanding the medium- and long-term impacts on the demographic groups that tourism employs, particularly youth. People aged 15-24 filled 31% of tourism jobs in 2016, according to the census. A survey of 5,000 Canadians showed that 28% found their first job in one of the five tourism industries.2 Whether building a career within the industry or requiring a job flexible enough to accommodate a student schedule, frontline tourism jobs serve as key entry points to the labour force for young Canadians. The reduction in tourism employment is likely to delay their entry into the labour force and limit their early work experience, which can have longterm consequences for their career progression. Alternately, if these young people find employment elsewhere, it could create staffing difficulties for a labour-intensive industry once demand returns.

It will be important to understand how this crisis changes labour dynamics within the sector going forward. As emergency measures lift, employees will return to work under circumstances drastically different from those that existed in February 2020. They will require new skills adapted to new business models, new protocols and regulations, and modified products and services. Physical distancing will continue for some time to come. Businesses and employees must be constantly ready to adapt their procedures and behaviours as the situation evolves and new best practices are discovered. Many guides for reopening are being produced, but there is a lack of coherence. It is too early to tell exactly which protocols will be most effective in keeping guests and employees safe. Further loosening of restrictions can be expected, which will also require an ongoing evolution of best practices.

Labour market information will be key to understanding how human resource practices and policies will be overhauled. Employers need to know how traveller and employee expectations have changed. New public health and hygiene rules will no doubt be legislated. It will be necessary to understand if meeting those regulations will assuage the concerns of guests and employees, or if the sector will need to go above and beyond them in order to compete.

At the highest level, we need high-quality labour market information to understand the long-term outlook. When a sector that employed almost 10% of Canadians shuts down for several months and may not see a full recovery for years to come, what happens to its labour force? In particular, we must start working now to address what LMI people need to make better, more informed decisions in the aftermath of the pandemic.

The Way Forward

To move forward, we need ongoing flexibility in programs and policies that help businesses and employees cope. These programs will need to be adjusted based on LMI that assesses the ongoing impact to different sectors affected by COVID-19. Because of its reliance on domestic and international travel, tourism should be among the sectors considered for special support due to the massive disruption in demand.

Coherent COVID-19 protocols are key. The guidelines for different industries and business types will need to be comprehensive, explicit and consistent, with core public health and hygiene protocols that can be applied across Canada. This will help avoid consumer confusion, increase confidence in the health and safety practices of the industry and create fair conditions for everyone.

Finally, ongoing support for comprehensive labour market research and analysis will help track the tourism sector’s recovery. There are many questions for which we do not yet have answers. This will require the tracking recovery signals, changing travel patterns, employee perceptions and the long-term impact on employment. Cooperation amongst tourism sector stakeholders and the open sharing of data will be essential for informing recovery plans and strategies that will allow the tourism sector to move forward.

Acknowledgments

This LMI Insight Report was prepared by Calum MacDonald of Tourism HR Canada. We would like to thank staff at LMIC for their support in the development of this report. For more information about these issues, please contact Calum MacDonald, Vice President of Labour Market Intelligence, at cmacdonald@tourismhr.ca, or Zoe Rosenbaum, LMIC Economist, at zoe.rosenbaum@lmic-cimt.ca.

For information on other LMIC activities and products, please contact Tony Bonen, Director of Research, Data and Analytics, at tony.bonen@lmic-cimt.ca.

End Notes

- All figures are seasonally adjusted unless otherwise noted.

- These results are part of survey conducted by Tourism HR Canada, which will be published soon